This apprenticeship has been retired

A temporary dispensation has been applied to the Relationships Manager standard for this apprenticeship. The dispensation will last from 21st June 2023 to 21st June 2026 but may be withdrawn if the dispensation is no longer necessary.

The key changes are:

Providing financial products and services to customers, helping them achieve their business goals.

Relationship Manager (Banking)

The role has responsibility for providing products and services to a portfolio of customers, to help them achieve their business goals alongside delivering the Bank’s business plan, whilst meeting the required ethical, risk and governance standards. The role may sit in several different areas of the Bank eg Corporate, Commercial, Retail Banking, Wealth Management, Private Banking, Card Services. Depending on the customer base, it may have responsibility for a portfolio (SMEs) or be supporting a Director on larger customers. The apprenticeship will form part of a career path for the individual. Typical roles are likely to be junior to mid level relationship management positions. On completion it is likely to be similar to an individual exiting the graduate programme.

|

Knowledge |

What is required |

|

|---|---|---|

|

Ethical standards |

Understand the ethical standards that the organisation and industry requires of its employees and the implications of these for the role |

|

|

Product knowledge |

Understand the range of financial services products and services available to the customer portfolio, including pricing and margins |

|

|

Risk and Governance |

Understand the risk and governance frameworks of the organisation / industry and how these manifest themselves in the role. Keep up to date with changes. |

|

|

Market awareness |

Understand the local market in which the role operates eg demographics, economics, competition |

|

|

Customer understanding |

Understand the sector in which their customers operate, their business; together with the principles / tools of excellent customer service and relationship management |

|

|

Financial analysis |

Understand data/financial analysis, planning and modelling tools that are required for the role |

|

|

|

||

| Skill |

What is required |

|

|

Develop customer relationships |

Build ethically sound and ‘trusted adviser’ relationships with customers to form the basis of a long term partnership |

|

|

Identify and meet customer needs |

Work with customers to identify their ongoing business challenges. Provide flexible and innovative solutions, integrating products and excellent service, that help them meet their goals |

|

|

Manage governance and risk |

Apply the organisation’s risk and governance frameworks to ensure that all activities are compliant and breaches are minimised |

|

| Deliver commercial results |

Support, develop and deliver an account plan that meets internal goals and is based on customer needs across the portfolio. Apply financial analysis techniques relevant to the area of the bank eg provide guidance on credit appetite; develop practical and appropriate credit solutions /lending structures; maximise portfolio return |

|

|

Communication and relationship building |

Use a range of advanced communication and influencing techniques to build sound relationships both externally and internally |

|

| Teamwork | Bring the right people and functions together, both internally and externally, to collaborate and deliver for the customer | |

The apprentice will typically specialise in a particular area of banking eg Corporate/Commercial; Retail; Wealth. Market Awareness and Customer Understanding competencies will be specific to that area. The track taken within the full qualification below will contain core elements plus specifics for the area eg Professionalism, Ethics and Regulation module as a core; Retail Financial Services module as a specific. Products that will be covered in each area will differ eg

The apprenticeship will typically take 4 years to complete.

Individual employers will set the selection criteria for their Apprenticeships. Most candidates will have A levels or existing relevant Level 3 qualifications. Other relevant or prior experience may also be considered as an alternative. Employers who recruit candidates without English or Maths at Level 2 or above must ensure that the candidate achieves this standard prior to taking the end-point assessment.

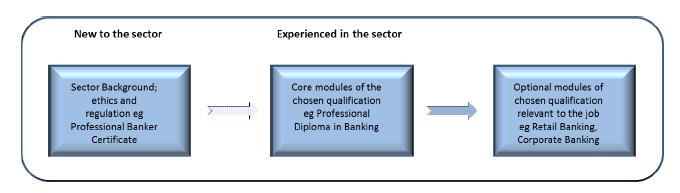

Professional qualifications within this apprenticeship depend on the level of experience in the sector and the areas of the bank that the apprentice works in as shown in the diagram below.

knowledge of the sector, ethical and regulatory background – done within the first 3-6 months for those new to the sector – L3 – one of:

Full qualification for the role (both contain tracks relevant to different functions in banking)- one of :

New apprentices:

Existing apprentices part way through studies will continue on their qualification listed below following any transitional arrangements as shown on www.charteredbanker.com :

Professional body memberships that are relevant options for this apprenticeship are:

Retail banking: Chartered Banker Institute; London Institute of Banking & Finance

Wealth: Chartered Banker Institute; London Institute of Banking & Finance; Chartered Institute of Securities and Investment; Chartered Insurance Institute

Corporate Banking: Chartered Banker Institute; London Institute of Banking & Finance; CFA Institute (Chartered Financial Analyst)

Level 6 apprenticeship, enabling the relationship management career track to reach the same level as a graduate.

The apprenticeship should be reviewed after a maximum of 3 years.

Crown copyright © 2024. You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. Visit www.nationalarchives.gov.uk/doc/open-government-licence